Claims Analytics Solutions

See the forest for the trees

See the forest for the trees

Both insurers and manufacturers can benefit from the analysis of claims data. Claims analytics helps you answer numerous business questions and improve your business processes. However, this is not an easy task. The dominant portion of claim information is stored as free text: medical records, adjuster notes, customer statements, repair notes, etc. If you cannot consistently pull relevant facts from millions of text records, you might as well forget about claims analytics altogether.

Our goal is to enable efficient claims analytics. We provide software that can extract important information dispersed through the text notes associated with claims. We submit the distilled knowledge, along with the original structured attributes, as the input to machine learning algorithms that create predictive models for anticipating future outcomes and for detecting systematic anomalies.

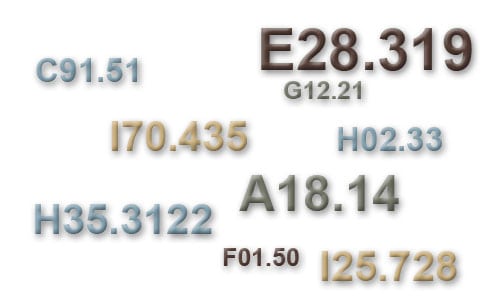

Use machine learning to assess the accuracy of ICD-10 codes assigned to medical records. Assess whether your billing is using the right codes. The system can operate both as an automated classification system, or merely as a decision support tool. Use our software to increase your confidence in the accuracy of selected codes.

Use the power of machine learning to identify normal behavior patterns and detect anomalous behavior. Reveal the most suspicious providers and investigate the cause of anomalies. Setup the software to access to your data, perform any necessary merging and joining of different sources of data, check for errors in data entry, select from a plethora of algorithms with which to investigate, and study the results.

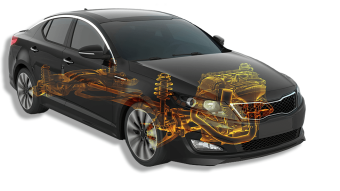

Go beyond the traditional statistical data analysis techniques applied to claims data. Our software, PolyAnalyst, provides a suite of tools that help you dig deeper into the textual data associated with claims, and use this additional evidence as criteria in detecting and even predicting subrogation outcomes.

Detect litigation threats and arm your legal team with the summary of key facts extracted from claim notes.

Identify claims, adjusters and customers that do not fit normal behavior patterns. Determine the cause of the anomaly.

Determine patterns and trends for key drivers of the repair cost. Pinpoint root causes of problems and the corresponding successful repair actions.

Monitor your data for previously unknown issues that might have the potential to become major headaches in the future, if not quickly addressed.

Spot systematic anomalies in the behavior of some dealers in your network. Identify operational patterns that cause these anomalies.